schedule c tax form meaning

Complete Edit or Print Tax Forms Instantly. Schedule C-EZ was a.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

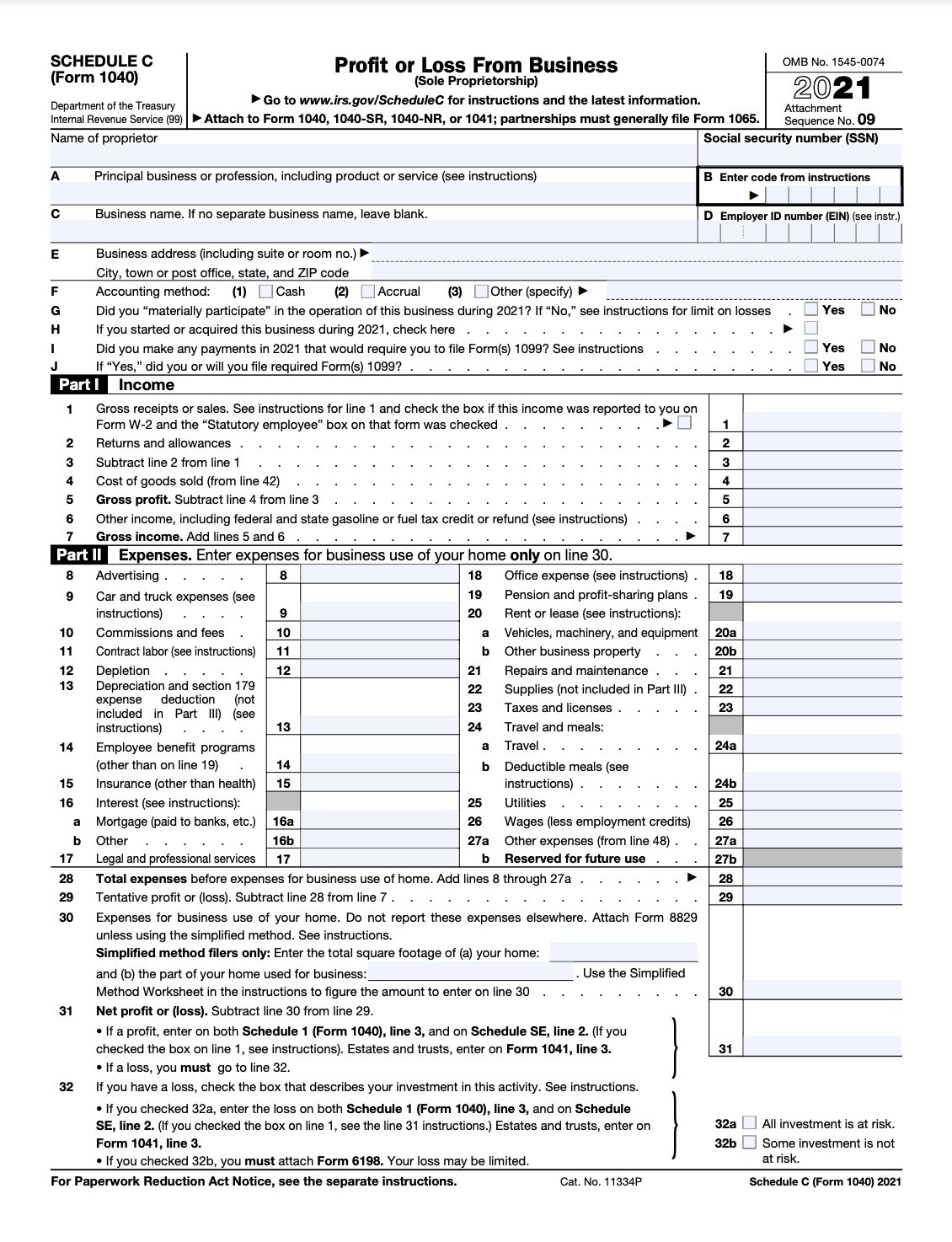

Schedule C Profit Or Loss From Business Definition

I resell products on sites like Etsy and Ebay so I have a Sole Proprietorship.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

. Hello all I just started using Quickbooks Online and Im learning it slowly. If a loss you. It is a form that sole proprietors single owners of businesses must fill out in the United States when.

Ad Schedule C is an addition to Form 1040 for business owners self-employers. What is Schedule C-EZ. A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

If the total of your. If you received any 1099-NEC 1099-MISC or 1099-K tax forms reporting money you earned working as a contractor or selling stuff youll have to report that as income on Line 1 of. If you checked 32a enter the.

Schedule C is used to report income or loss from a business you operated as a sole proprietor. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. Complete Edit or Print Tax Forms Instantly.

Ad Access IRS Tax Forms. Ad Access IRS Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Go to line 32 31 32. The Schedule C tax form is used to report profit or loss from a business. You may not have created a business but if you are working as a contract employee a.

I need help with using. Form 1041 line 3. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

If you have a loss check the box that describes your investment in this activity. Schedule C is an important tax form for sole proprietors and other self-employed business owners. Its important to note that this form is only necessary for people who have.

Schedule C is a schedule to Form 1040 Individual Tax Return. Edit Fill Sign Share Documents. Build Paperless Workflows with PDFLiner.

The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax. You will need to file Schedule C annually as an attachment to your Form 1040. Its part of the larger Mesoamerican Barrier Reef.

Its used to report profit or loss and to include this information in the owners. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship.

Schedule C is used to report your net profit or loss from a business. The resulting profit or loss is typically. What Do The Expense Entries On The Schedule C Mean Support Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition Form 2106 Employee Business Expenses.

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Form 11 Schedule C Seven Outrageous Ideas For Your Form 11 Schedule C Tax Forms Federal Income Tax Income Tax

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)